High Interest? Not Interested.

No Payments up to 90 Days!*

Loans

We offer low interest financing for every need. Apply for a Home, Auto, Boat, RV, Personal, or Student Loan.

E-Services

Account access, anytime anywhere with our Mobile App, Online Banking, and the MoneyPass Network.

Checking

Safe, Secure, and Convenient! No Monthly Fees! No Minimum Monthly Balance Requirement!

How can we assist you?

Student Loans

Variable and fixed interest rates

Investments

Save for Your Financial Future

Home Equity Loans

Fixed Rate Home Equity Loan

Auto Loans

Make No Payment for 90 Days!

Personal Loans

Fast, Secure, Low Interest!

Savings Accounts

Start Saving Today!

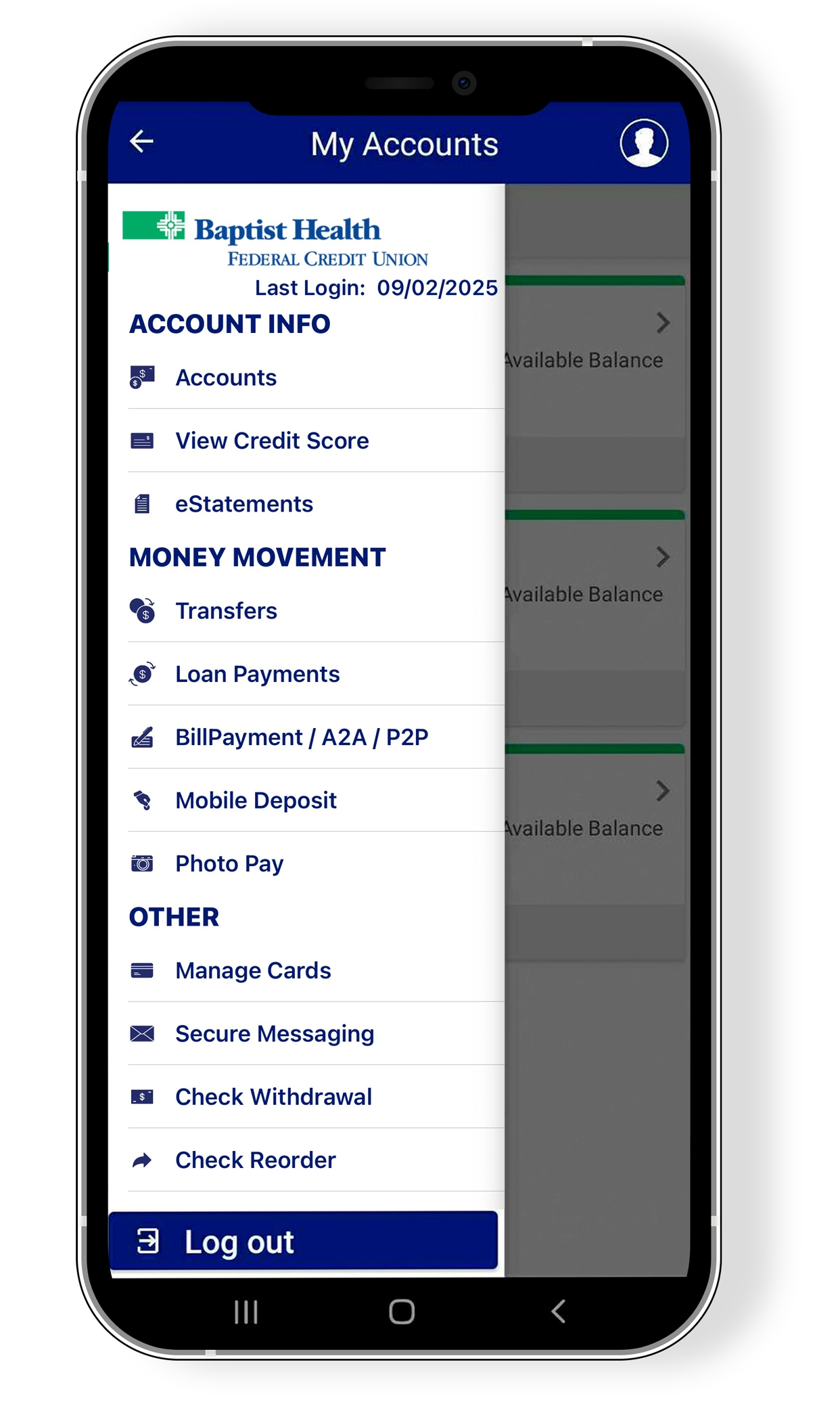

Meet the BHFCU Mobile App

The Baptist Health Federal Credit Mobile App has always given members a fast, secure, and easy way to access accounts anytime, anywhere. In addition to checking balances, viewing transaction history, and finding ATM’s, the new BHFCU Mobile App features the following:

Transfer Funds

Transfering money has never been easier! The new BHFCU Mobile App allows you to send money person to person (P2P) or from account to account (A2A).

Deposit Checks

Introducing E-Bill. Search for your biller and find out due dates, account balances, and pay your bills!

Bill Pay

Check your credit score anytime without harm when you opt-in for our FREE credit monitoring program!

Credit Score

Sign, Snap, and Send! Deposit checks as soon as you receive them with mobile check deposit!

Alerts

Setup both security and account alerts that you'll receive by email, text, or both.

Secure Messaging

Communicate directly with BHFCU during regular business hours with Secure Messaging.

My Card

Turn your ATM Debit Card ON or OFF from the BHFCU Mobile App! My Card is just another secure and convenient option that we provide our members who want to take advantage of the BHFCU Mobile App!

Reorder Checks

Did you know that you can reorder checks in the BHFCU Mobile App? Simple, easy, convenient!.